Quick tips to master your finances, one tracker at a time.

Why You Need a Budget Planner

It’s easy to overspend, forget bills, or miscalculate what you actually have in your account. Even small mistakes add up. A budget planner gives you a clear, visual view of your money so you can take control instead of reacting to chaos.

If you’re looking for more quick money tips, tricks, and tools to help you master your cash flow, check out ConvertItQuick.com — your go-to blog for fast, actionable finance advice.

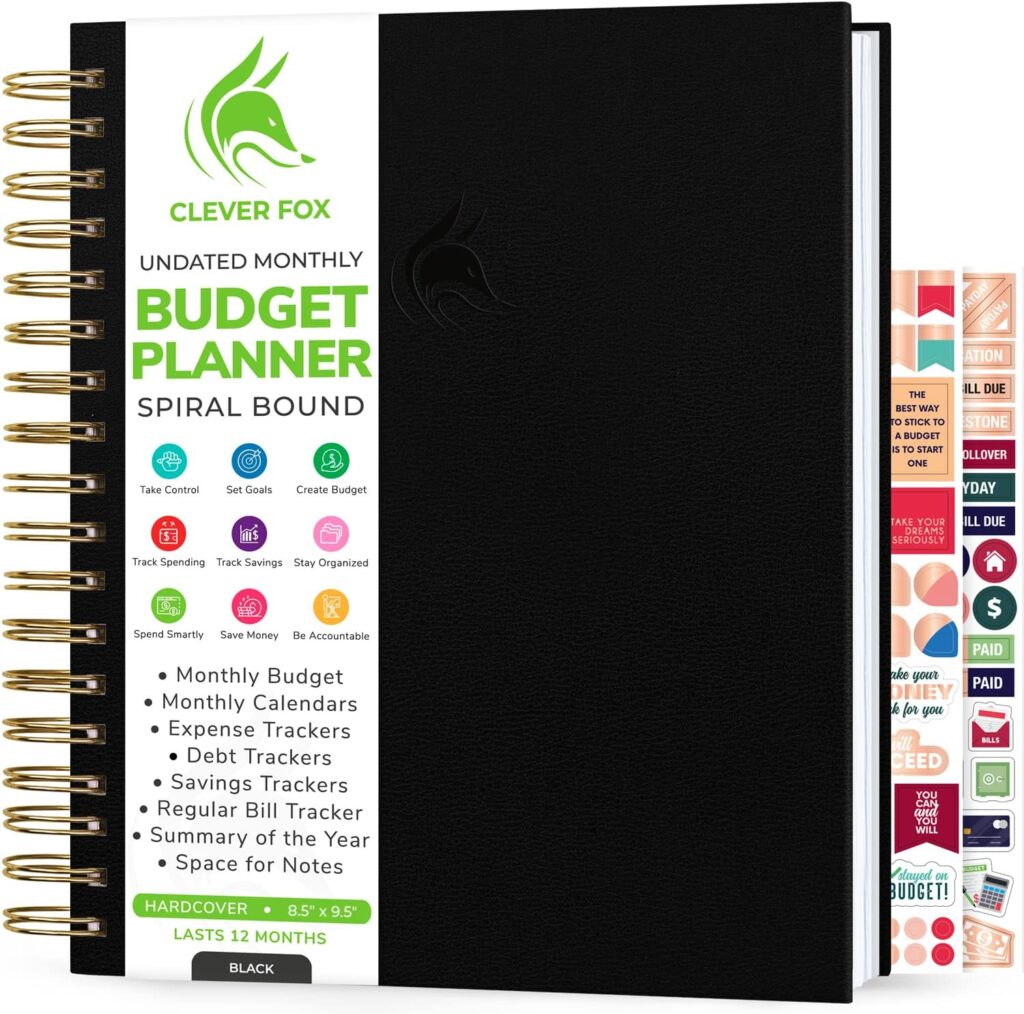

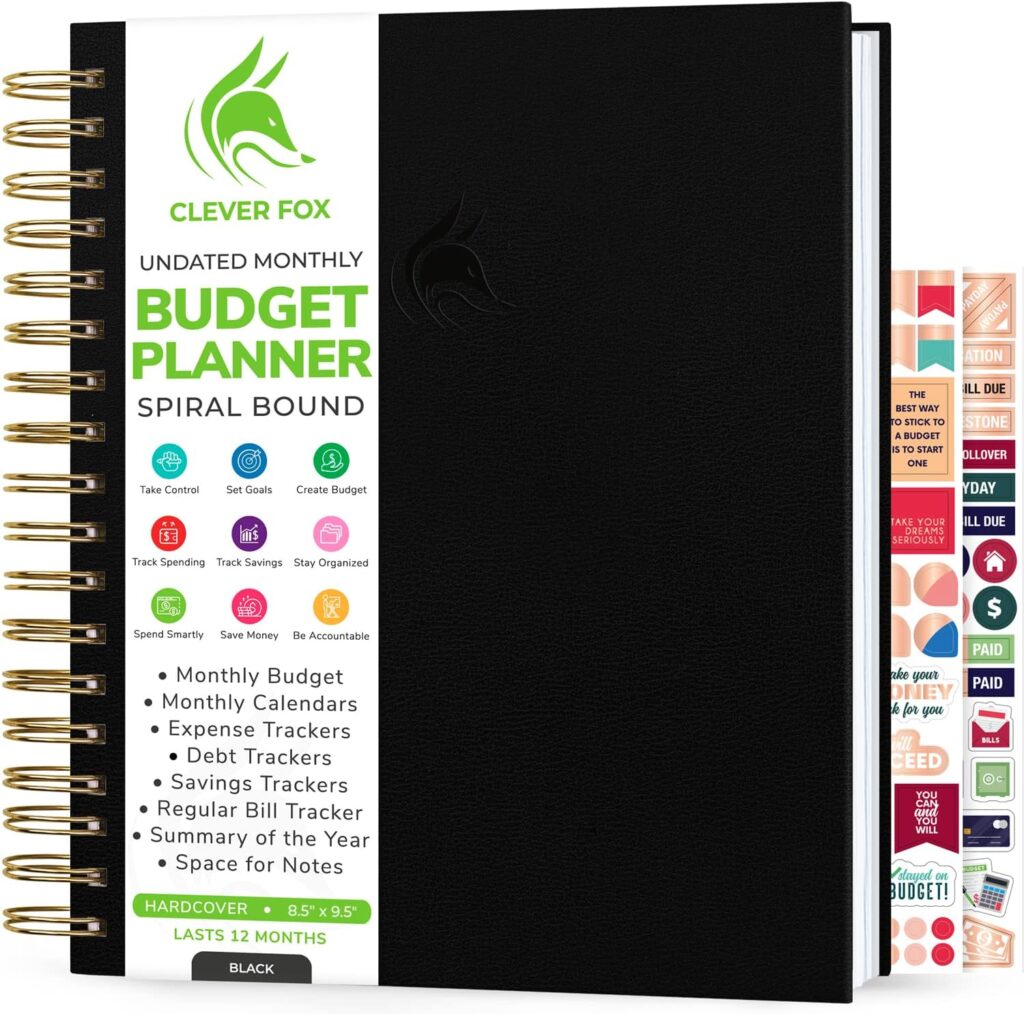

How the Clever Fox Budget Planner Helps

The Clever Fox Budget Planner – Expense Tracker Notebook is built for people who want simplicity and action. You can track monthly expenses, income, bills, and savings goals all in one place. The A5 size fits anywhere, so you can use it at home or take it with you on the go. It’s designed to turn planning into a habit, so your money actually works for you instead of disappearing unnoticed.

Quick Tips for Using Your Planner Effectively

- Start with the essentials: Log your monthly income and fixed expenses first.

- Track every dollar: Write down every purchase, no matter how small — the numbers add up.

- Set weekly check-ins: A quick review keeps you aware and prevents overspending.

- Use it for goals: Track your savings or debt payments to see progress, not just expenses.

Why This Is Better Than Apps Alone

Apps are great, but there’s something about writing it down that makes it stick. Seeing numbers on paper helps your brain process the reality of your spending. You’ll notice patterns you might miss with a phone app.

Get Your Planner

If you’re ready to finally take control, grab the Clever Fox Budget Planner – Expense Tracker Notebook here: https://amzn.to/48odEFr

For more quick and actionable money tips like this, make sure to visit ConvertItQuick.com — your one-stop spot for making your money work for you.

This post contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you.

Leave a Reply