Simple steps today can make a big difference in your wallet tomorrow

Stay Ahead of Your Finances

Managing money doesn’t have to be complicated. Even small tweaks in how you track, save, or plan your spending can make a huge difference. Start by keeping a daily log of expenses — knowing where your money goes is the first step to controlling it.

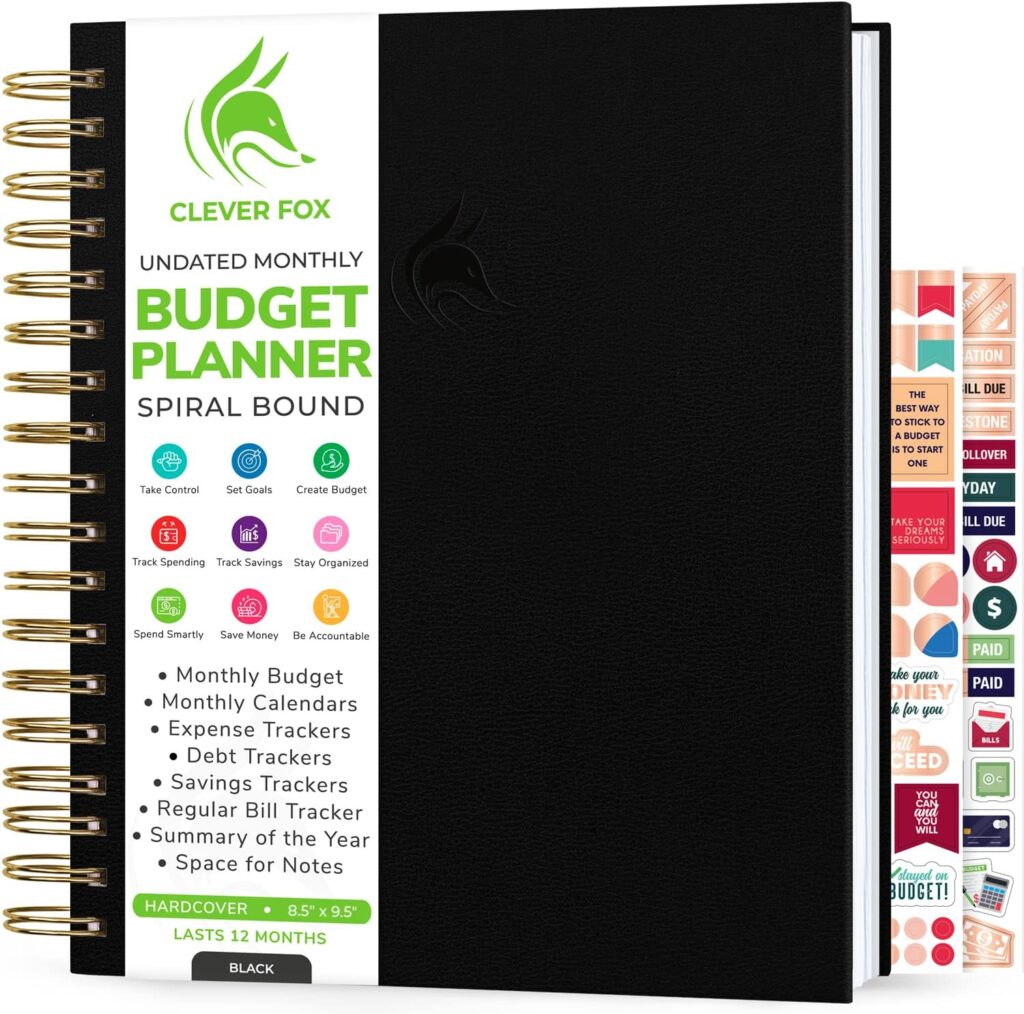

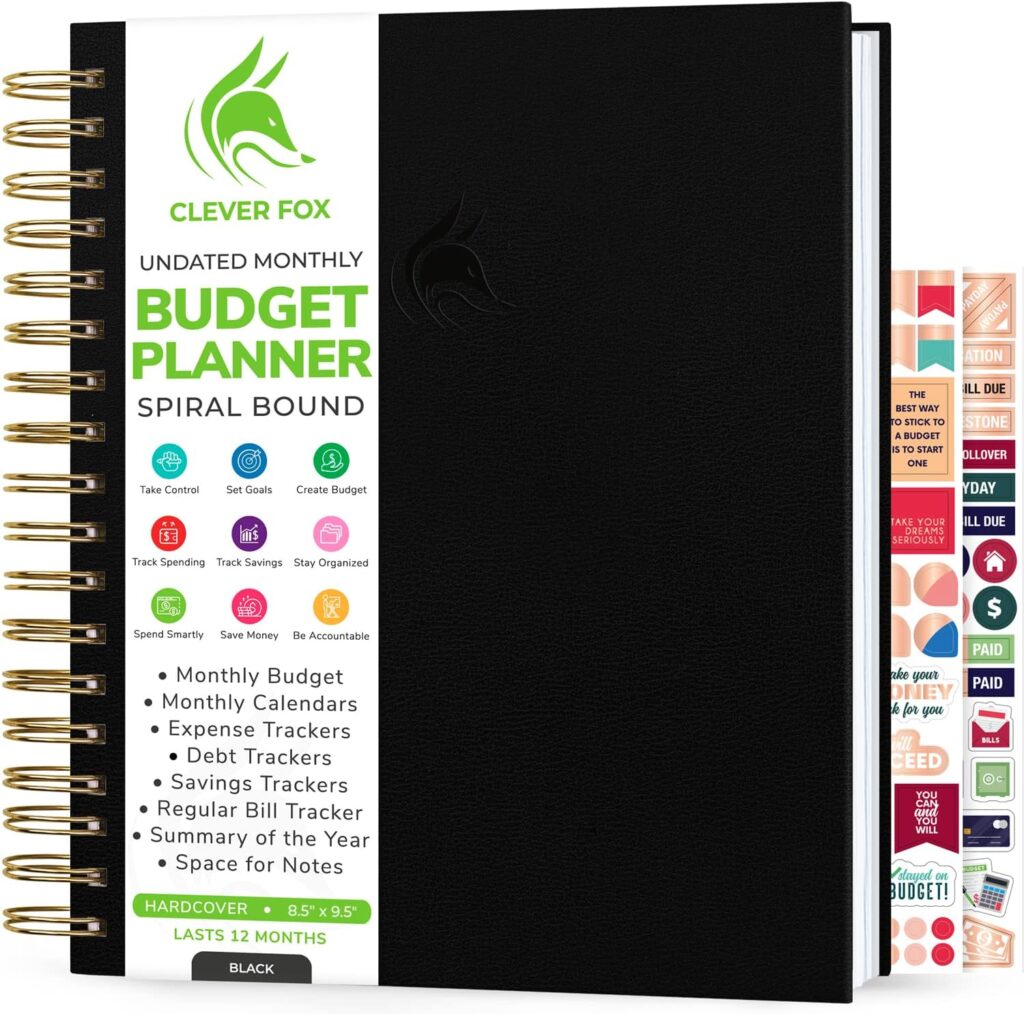

Use Tools That Work For You

Whether it’s a digital budget tracker, a simple spreadsheet, or a dedicated finance notebook, having one place to organize your bills, savings, and goals keeps you on track. One great option is the Clever Fox Budget Planner, an expense tracker notebook that helps you organize monthly budgets, track bills, and log accounts. You can check it out here: https://amzn.to/48odEFr. For extra help, visit convertitquick.com where you can find tools to make tracking, budgeting, and planning your finances even easier. Don’t overthink it — consistency beats complexity.

Plan for the Unexpected

Life throws curveballs, and your finances should be ready. Set aside a small emergency fund each month, even if it’s just a little. Over time, it grows, giving you a safety net for those unexpected expenses.

Keep Learning

Financial literacy is a journey, not a destination. Follow blogs, read books, watch tutorials — every tip you pick up adds up. The more informed you are, the smarter your money decisions will be.

Take Action Today

Pick one tip from this post and apply it immediately. Track your spending for a week, start a mini emergency fund, or use one of the helpful tools at convertitquick.com to organize your finances. Action, not intention, creates change.

Conclusion

Money management is a skill you build day by day. With simple habits, the right tools, and a proactive mindset, you can take control and make your finances work for you. Start today and let your small efforts grow into big results.

Disclaimer: This post contains affiliate links. If you make a purchase through these links, I may earn a small commission at no extra cost to you.